The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Energy star window rebates 2017.

How do i apply for a windows doors and or skylights tax credit.

Rebate of 0 40 sf of window film for energy star window film.

The energy star rebates and incentives directory provides information on energy star rebates and incentives offered by the federal provincial and territorial governments municipalities electric and gas utilities in canada.

Window and door rebates amount.

Find rebates and special offers near you on energy star certified products.

In order to get the tax credit you must have windows that are energy star certified.

Rebates are available for the installation of windows that can reduce energy.

Epa helping you save energy and money while protecting the environment.

Energy star for northern climate zone.

Click here to search for energy star.

More eligibility requirements can be found here.

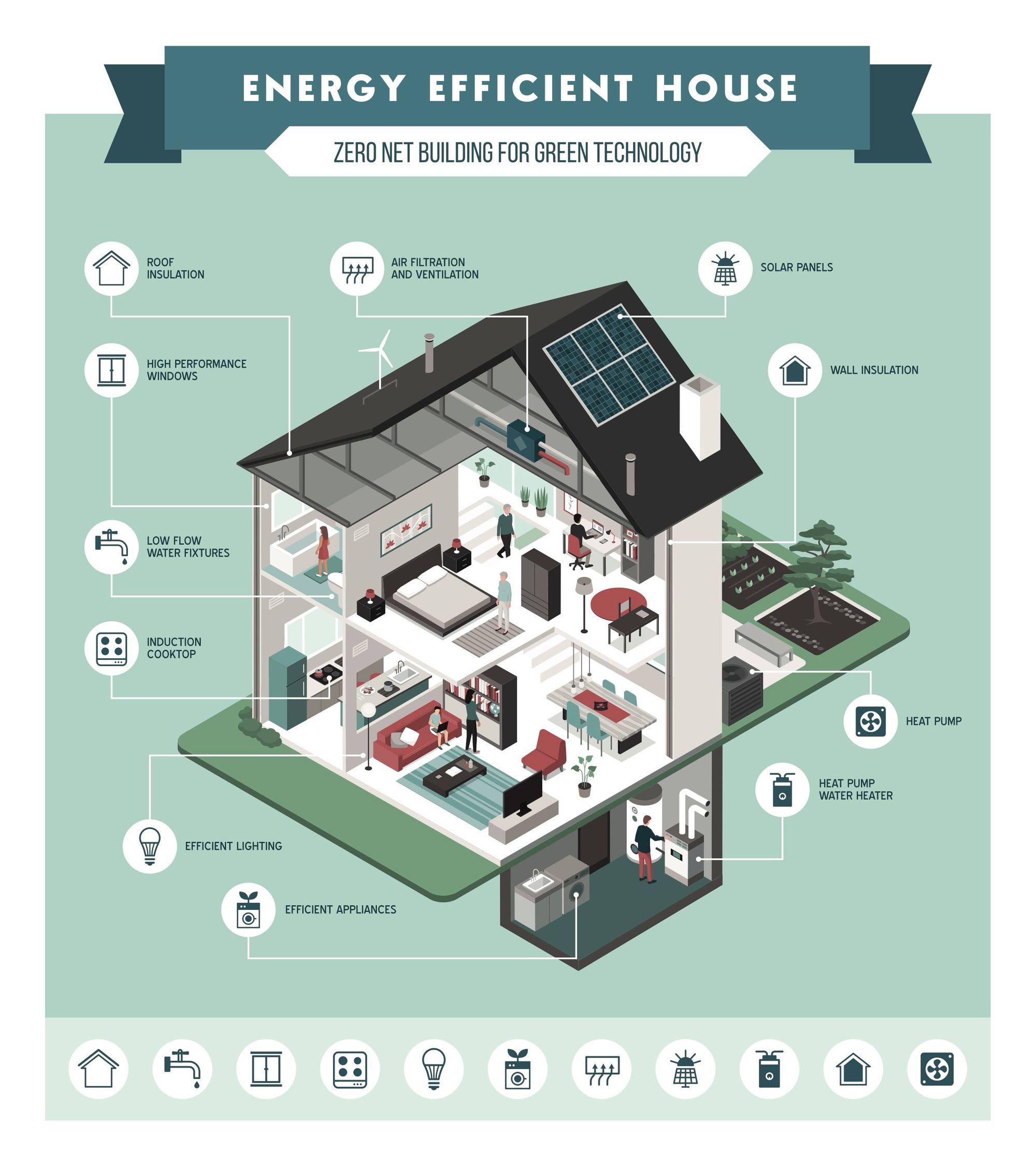

Residential home improvement rebate program rebate of 1 60 sf of window for energy star windows.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

10 of the cost up to 500.

The federal government offers tax credits on energy efficiency products too.

U value 0 30 15 per unit.

Not all of your windows need to be installed replaced to qualify.

There are also special credits for installers.

Existing windows must clear glass.

Not including installation energy efficient window costs are covered by 10 up to 200.

The replacement windows doors or skylights must be energy star certified products.

U value 0 30 opening must be at least 30 sq.

Energy star for northern climate zone.

Film must have a shgc of 0 50 or less.

Glass patio door unit sliding patio door or picture window.

But also with tax credits rebates.

With up to 475 for insulation 40 per door and 15 per window rated energy star northern climate zone you can earn a lot back on your upgrades while saving on your energy bill too.

Federal income tax credits and other incentives for energy efficiency.

Here are the 2020 energy star tax credits for windows doors and other products.

They serve as an added incentive to sell and install energy efficient products.

Products that earn the energy star label meet strict energy efficiency specifications set by the u s.

When you submit your 2016 tax return file form 5695 residential energy credits here.

Energy efficient windows offer the potential for improving comfort in the home and lowering the costs of heating and cooling.

That s why we offer you rebates to support your upgrades.